How we use your money

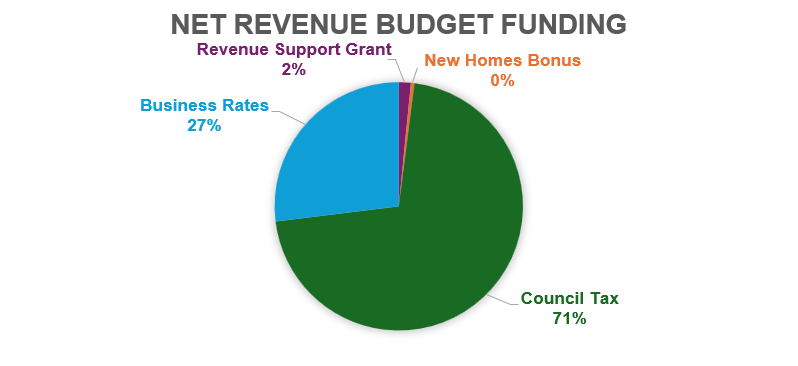

The council’s budget pays for day-to-day services such as Adult Social Care, Children’s Services, Waste and Recycling, Planning, Transport, Highways, Street Cleaning, Parks, Playgrounds, Libraries and Environmental Health. The council has set a gross revenue expenditure budget of £476.1 million for 2025/26 and of this, £126.1 million – just over a quarter – is funded by your Council Tax. The rest is funded from a range of sources including Business Rates, income from fees and charges, and funding from grants.

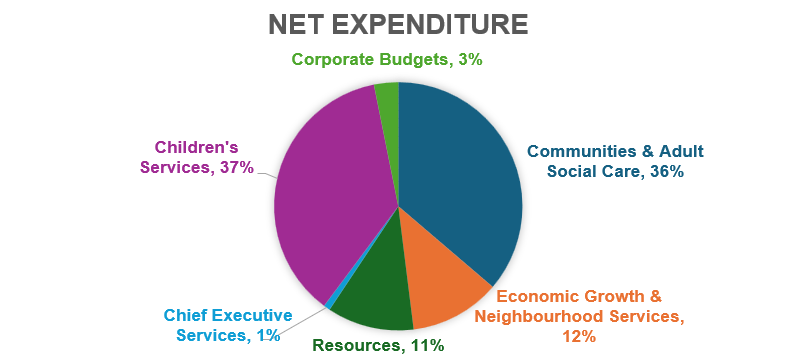

The chart below shows the relative proportions of the net revenue budget requirement of £178.1m to be spent in each of the key service areas for 2025/26.

Budget by directorate in 2024/25 and 2025/26

| Directorate / Service | Budget 2024/25 (£m) | Budget 2025/26 (£m) | Change (£m) |

|---|---|---|---|

| Communities & Adult Social Care | 58.6 | 64.6 | 6.0 |

| Economic Growth & Neighbourhood Services | 22.7 | 21.0 | (1.7) |

| Resources | 21.4 | 20.2 | (1.2) |

| Chief Executive Services | 1.5 | 1.5 | 0.0 |

| Children’s Services | 59.7 | 65.3 | 5.6 |

| Corporate Budgets (inc. Capital Financing) | 4.0 | 5.5 | 1.5 |

| Net Budget Requirement | 167.9 | 178.1 | 10.2 |

Gross income and expenditure in 2024/25 and 2025/26

| Income / Expenditure | Budget 2024/25 (£m) | Budget 2025/26 (£m) | Change (£m) |

|---|---|---|---|

| Gross Expenditure | 486.8 | 476.1 | (10.7) |

| Gross Income | (318.9) | (298.0) | 20.9 |

| Net Budget Requirement | 167.9 | 178.1 | 10.2 |

How the budget in 2024/25 and 2025/26 is funded

| Funded by | Budget 2024/25 (£m) | Budget 2025/26 (£m) | Change (£m) |

|---|---|---|---|

| Business Rates (inc. S31 Grant) | (48.0) | (47.9) | 0.1 |

| Revenue Support Grant | (2.7) | (2.8) | (0.1) |

| New Homes Bonus Grant | (1.3) | (0.8) | 0.5 |

| Other Government Grants | (1.2) | 0.0 | 1.2 |

| One-off Collection Fund (Surplus)/Deficit | 4.2 | (0.5) | (4.7) |

| Total Funding (excluding Council Tax Requirement) | (49.0) | (52.0) | (3.0) |

| Council Tax Requirement | (118.9) | (126.1) | (7.2) |

| Total Funding | (167.9) | (178.1) | (10.2) |

Council Tax and the Adult Social Care precept

In 2025/26, the council’s element of Council Tax will increase by 4.99% – an increase of £1.93 per week for a Band D property (£1.71 a week for a Band C property). The majority of properties in Reading are Band C and below. The change is made up of a 2.99% increase in general Council Tax and a 2.00% increase for Adult Social Care.

This increase in the Adult Social Care Precept will raise £2.4 million for Adult Social Care and will help us to continue to protect vulnerable adults in the borough. Our Adult Social Care budget has increased by £5.1 million for 2025/26.

Thames Valley Police and Berkshire Fire and Rescue

Your Council Tax also helps to pay for services delivered by Thames Valley Police and the Royal Berkshire Fire and Rescue Service.

Further information on the budgets and Council Tax requirements for these services can be found at:

Council Tax Leaflets · Thames Valley Police & Crime Commissioner (thamesvalley-pcc.gov.uk)

Berkshire Fire and Rescue – financial transparency

Breakdown of Council Tax charges (Band D equivalent)

| Reading Borough Council (Own Purposes) | 2024/25 | 2025/26 | Change |

|---|---|---|---|

| Band D Equivalent Charge (Excluding Adult Social Care) | £1,726.19 | £1,786.49 | £60.30 |

| Band D Equivalent – Adult Social Care | £290.69 | £331.03 | £40.34 |

| Band D Equivalent (A*) | £2,016.88 | £2,117.52 | £100.64 |

| Police and Crime Commissioner for Thames Valley | 2024/25 | 2025/26 | Change |

|---|---|---|---|

| Total Budget Requirement | £557.9m | £594.9m | £37.0m |

| Reading Precept | £15.9m | £16.9m | £1.0m |

| Band D Equivalent (B*) | £269.28 | £283.28 | £14.00 |

| Royal Berkshire Fire and Rescue Service | 2024/25 | 2025/26 | Change |

|---|---|---|---|

| Total Budget Requirement | £46.0m | £48.0m | £2.0m |

| Reading Precept | £4.8m | £5.1m | £0.3m |

| Band D Equivalent (C*) | £81.31 | £86.31 | £5.00 |

| *Total | 2024/25 | 2025/26 | Change |

|---|---|---|---|

| Grand Total Band D Equivalent (A+B+C) | £2,367.47 | £2,487.11 | £119.64 |

Environment Agency

The Environment Agency charges local authorities, including Reading Borough Council, a levy for providing flood defence. In the Thames region, this includes maintenance of the river system and the operation of a flood warning system. In 2024/25 the Council was levied £140,370, and for 2025/26 the council has been levied £142,335. These costs are included within the Corporate Budgets for Reading Borough Council.